Renting your property on Airbnb is a great way to earn some extra cash. If you live in the UK, short term lets (STR) otherwise known as a Furnished Holiday Let (FHL) has its tax benefits, and you need to be aware of them to file tax on your Airbnb income correctly.

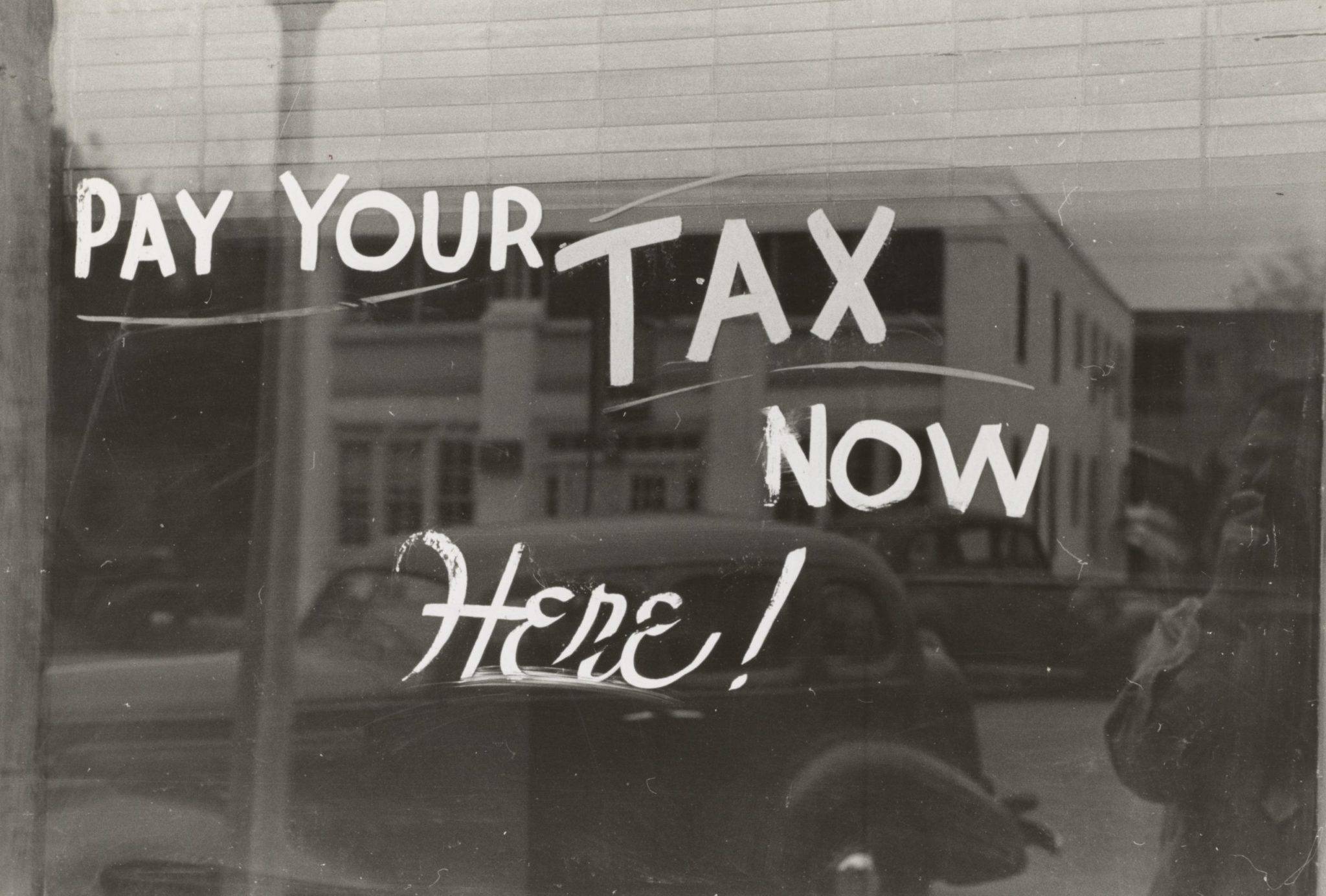

It is always better to be proactive with tax matters things instead of risking tax penalties down the line – especially when there are tax benefits and allowances that can work to your advantage as a host.

Convered in this post

Does my property qualify as a Furnished Holiday Let (FHL)?

As per HMRC guidelines for FHL’s, your Airbnb qualifies as ‘Furnished Holiday Let’ for tax purposes it must:

- be in the UK or the European Economic Area (EEA)

- be furnished – there should be sufficient furniture provided for regular occupation

- be available for letting for at least 210 days of the year

- have been rented out for at least 105 days as a short term let

How much tax do I have to pay on Airbnb income?

It depends on whether you are:

- renting out a room in your primary residence

- renting out an investment property

If you are letting a place in your own home, several tax-free allowances and advantages can be gained.

If you are running an Airbnb business involving an investment property or a property you do not live at full-time, it will be taxed as a business.

Business rates on FHL's in the UK

Airbnb hosts who own investment properties in the UK may be subject to business rates.

It may vary depending on the part of the UK your property is in:

In England, a property that is available to let for 140 days or more in a year is classed as a self-catering property and is subject to business rates.

In Wales, a property that is available to let for at least 140 days in a year and is rented for at least 70 days is subject to business rates.

In Scotland, a property that is available to let for at least 140 days in a year may be subject to business rates.

It is advised to reach out to a local assessor to look at the property type, its size and location to estimate the rateable value.

Council Tax or Business Rate?

If your property qualifies for business rates (as explained above), you do not need to pay council tax. Instead, you are liable to pay business rates on the rated value of the property.

Along with this, you may need to pay corporation tax and other commercial taxes.

Can I offset letting losses against other income?

It was possible up until April 2012, but unfortunately, the UK government no longer allows Airbnb hosts to offset their FHL losses against other income.

However, the current system allows you to offset Airbnb income losses against future profits for the same property.

Airbnb tax UK: Do I need to pay VAT?

Yes if your rental income crosses the VAT threshold of £85,000 in a year.

You will need to register for VAT, and you will need to absorb this cost yourself as you can not charge additional VAT to guests on Airbnb.

The advantages of paying tax on FHL

If your property qualifies as an FHL, you can benefit from the following:

- Profits are considered as your earnings for pension purposes

- Unlike standard tenancy, allowances can be claimed for fixtures, furnishings and certain types of equipment in the property

- You may qualify for Capital Gains Tax relief programs such as the Entrepreneurs’ Relief, or Business Asset Rollover Relief.

What is Capital Gain Tax Relief?

If the property qualifies as an FHL and if it’s not your primary residence, you are entitled to capital gains tax relief. It may include:

- Just 10% capital gains tax rate instead of 28% when you sell your property.

- Ability to avoid capital gains tax on the sale of a property when you sell an FHL property and buy another under the Rollover Relief scheme.

- Ability to defer paying capital gains tax under the Gift Hold Over Relief scheme, which involves the owner giving away his business assets or selling them for less than they are worth to help the buyer.

What is Entrepreneurs relief?

Also known as Micro-Entrepreneurs Allowance, is a UK government scheme aimed at supporting small-entrepreneurs who are letting out properties or trading on websites such as Airbnb.

It allows recipients to deduct a £1,000 Micro-Entrepreneurs Allowance from their gross income to arrive at their taxable income figure, as opposed to calculating taxable profits by subtracting the actual expenses.

Important: You can not claim Micro-Entrepreneurs Allowance as well as the Rent A Room Relief on the same income.

Rent a room tax free threshold

If you are renting out a room in your primary residence, first £7,500 of your rent is tax-free in the UK as part of the Rent A Room Relief Scheme.

This rule does not apply if you run Airbnb in an investment property.

Need help with your Airbnb tax in UK?

There are many online resources to help you understand more about paying tax on your Airbnb income in the UK, here are a few I recommend:

TaxScouts – Airbnb tax return specialists and recommend by Airbnb. They submit your tax return for £119 all-inclusive and if you go via this link, you will get a 10% discount.

Airbnb Guidance on the UK taxation of rental income

Please note, this post is for informational purpose only. It is not legal advice. If you’re unclear about how any of these laws apply to you, seek advice from a lawyer or other legal advisor.